What Anna Delvey’s Ankle Monitor Can Teach Us About Marketing Strategies

Chloé Asconi Feldman

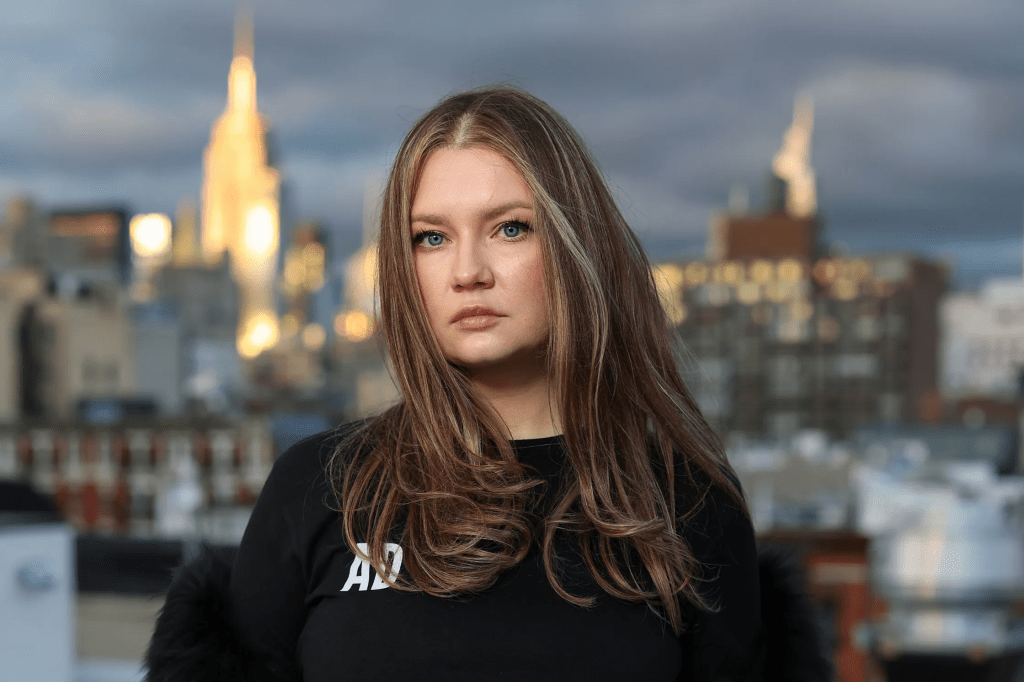

At this stage, it is unlikely that one is active online or in the pop culture sphere without knowledge of the convicted con-artist-turned-socialite Anna Delvey. Recently making her debut on Dancing with the Stars with her bedazzled ankle monitor, Anna Sorokin, known familiarly as Anna Delvey, is known for posing as an upper-class heiress to the New York elite and swindling hundreds of thousands of dollars, eventually finding herself in jail for almost four years on the charge of grand larceny. Despite her criminality, Anna Delvey has been taken on by the general public as a new socialite, featuring on magazine covers and even gaining support from the “Eat the Rich” movement. The narrative surrounding Delvey is fascinating in itself, but her recent rebrand from con to dancer can also offer valuable insights into effective marketing strategies.

Scheming to Streaming: Swindling Scarcity

I had never given much thought to the television series Dancing with the Stars, but upon learning that Delvey would feature in the upcoming season, I found myself suddenly intrigued. This is because Delvey holds an air of alluring exclusivity; with her jail time and limited public appearances, seeing her on a television series increases the appeal of tuning in and engaging with show material. This phenomenon resembles the scarcity principle of marketing, a strategy where marketers urge customers to engage with a good or service based on its finite nature, whether numerically limited or seasonal.

A brand notorious for its scarcity marketing is Hermès and its infamous Birkin bag. Social media frequently showcases celebrities carrying their Birkins as everyday bags; however, if one tries to buy one in a Hermès store they are met with a waiting list with an indefinite length. This scarcity of the product is what makes the Birkin so notorious, compared to other high-end designer bags – consumers are willing and able to wait to obtain a status indicator. This technique encourages customers to buy a product or service because it feels exclusive. In the case of Delvey and her limited public appearances, this comes in the form of television viewership.

Influencer Marketing: Controversy or Commonality?

As controversial as she may be, Delvey proves once again how successful influencer marketing can be. Reaching just over a million followers on Instagram, the brands that Delvey partners with inevitably reach a wide audience. Yet what differentiates Delvey from other influencers is her status as an ex-con artist and her blurry public image. What makes influencer marketing especially differentiable is when an influencer with an indefinable allure posts about a product, compared to the typical state of the influencer world, which is plagued with fast-fashion and superficiality.

As a brand, choosing Delvey to promote your product may seem controversial and ill-advised as she is an ex-con artist, but there is no denying the reach and influence that her posting about products would have. By simply bedazzling her ankle monitor, the concept has gone viral on social media with many claiming Delvey as their Halloween costume inspiration. By crafting a sensationalist, American-dream presenting image, Delvey stands out among influencers and those interested will seemingly follow along.

Embracing Infamy: Brand Personas

Another marketing strategy that Delvey has executed to improve her personal brand is by embracing her controversy rather than ignoring it. While her story went viral when she was arrested in 2017, the Netflix series Inventing Anna, which documented the story of Delvey and her arrest, made it practically impossible to know about Delvey without associating her with scamming, scandal and fraud. Instead of shying away from this track record, Delvey’s Instagram bio states, “this is not financial advice”, and her bedazzled ankle monitor seems to embrace her criminal past rather than sweeping it under the rug.

This strategy is nothing new to the world of brand management; in recent times, companies are more willing to face their criticism head-on. Ryanair for instance is a champion in the social media sphere for being bold and abrasive when considering promotion and CRM. However, this has only augmented the attention the airline receives over social media, as their cavalier remarks are in line with the brand’s persona – bare, no-frills and to the point. For Delvey, the choice to lean into and accept her criminal past creates a more authentic personal brand that invites discussion and publicity, whether good or bad. Whether talking about a convicted conwoman or an airline, there is truth in the effectiveness of using humour and marketing to address criticism rather than sugarcoating it.

Overall, Delvey’s rebrand –and her ankle monitor– offer insights into contemporary marketing strategies. She has been able to maintain the spotlight while capitalising on her controversial past and creating a personal brand, whether you love it or hate it. By using influencer partnerships, the principle of scarcity, and embracing her past, Delvey has demonstrated that even the most unexpected elements may play a significant role in the marketing narrative, including a bedazzled ankle monitor and a dance routine.