An Interview with Clive Bourke, EMEA & APAC President of Daon

Fiachra Mooney

About Daon

Nestled in Dublin’s eminent Docklands one can find Daon, a digital identity trust company. Focusing on the Business-to-Business-to Customer (sometimes even B2B2B2C) and Business-to-Government-to-Customer sectors, it provides the backbone for many of the services you likely use on a regular basis.

You would be forgiven for not being too familiar with Daon, as you’re unlikely to see their brand name plastered around the internet. It generally provides the software and processes for its customers to integrate into their own apps and websites. Daon instead grows through its reputation of excellence and referrals and word of mouth from happy customers. TBR’s Chief Strategy Officer and Editor-in-Chief Sean Smith sat down with Daon’s EMEA & APAC president, Clive Bourke, to learn a little more about the firm and its contributions to the growing identity proofing and authentication industry and its implications for the future business landscape.

Origins of Daon

Daon derives its name from the old Irish word for person, similar to the modern word for people, daoine. The company was started in order to predict and provide the technology necessary to bring biometric authentication to the masses and reduce the need to memorise complex pins for multiple services and accounts.

Clive spoke about the importance that Enterprise Ireland (EI) played in helping the company to expand its global operations. EI missions in Japan and the United States offered a great pathway to meeting potential clients and partners, and to help the company maintain sustainable foreign expansion.

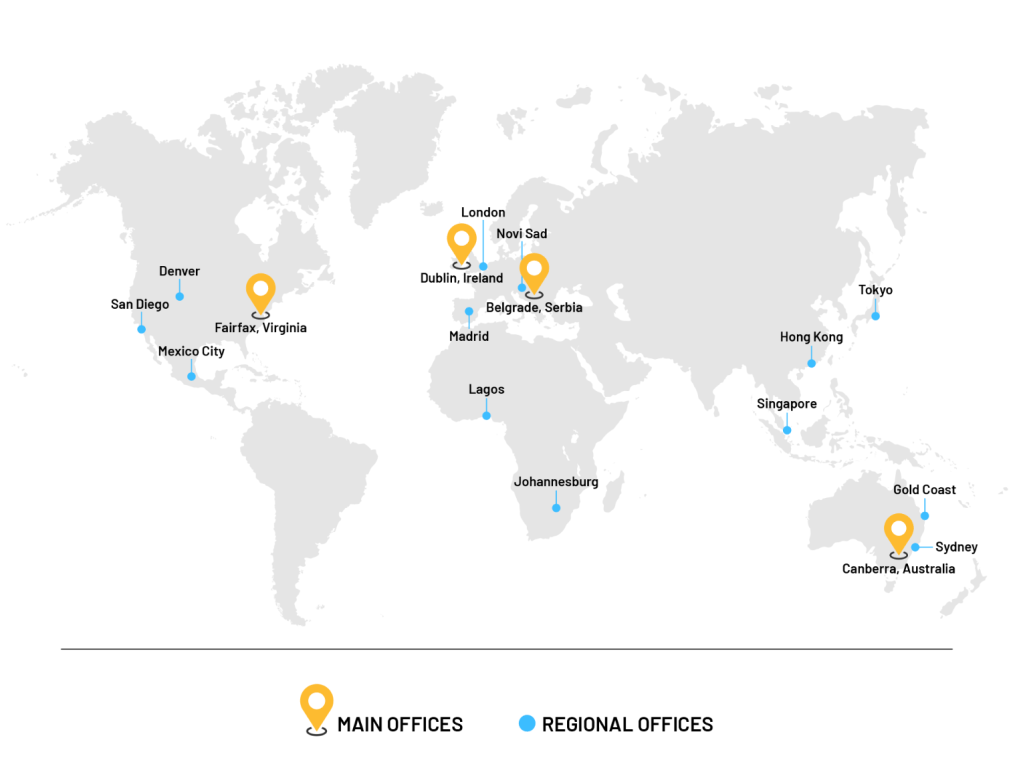

What started off as a small company in Dublin’s IFSC at the turn of the millennium has grown to a global operation with 17 offices spread throughout the world. Daon now has offices from Virginia right across to Canberra. While it is now a global operation, their headquarters and R&D remains in Ireland, as does their Chief Technology Officer. Their office in the IFSC remains the headquarters for EMEA.

Bread & Butter

Daon’s services provide the security underpinning for many financial institutions personal banking apps, enabling biometric authentication to facilitate new customer account opening and secure transactions for existing customers. There can be up to 50-100 different identity workflows between a customer and their service provider such as a bank. In the past, B2C firms would have had to design and implement all of these identity journeys themselves, but now Daon can provides a low code platform with configurable workflows that don’t require a lot of software development for not only financial institutions, but areas like travel and hospitality, telecommunication and social platforms.

Emerging Challenges & Areas of Interest

Voice to text

Clive discussed the popularity of voice commands that Amazon Alexa brought posed a new challenge for biometric authentication. If people wanted to conduct shopping with their Alexa devices, a problem arises as to how banks would be able to authenticate the purchase without forcing the customer to go onto another computing device. Voice commands for payments on home devices proved not to be as prolific as was originally expected however.

Deepfakes

Another relevant phenomenon for Daon, as Clive noted, is the advance of deepfakes in recent news. Despite the development of this deceptive AI over the last few years being rapid, their risk to biometric authentication certainty is minimal thanks to the work of companies like Daon. Firstly, deepfakes require a screen to be displayed, and Daon’s software can recognise when a picture is being shown on a screen. And while phones can be broken apart, and devices used to trick the phone into thinking that a deepfake is coming directly from the phone’s own camera (so called injection attacks), the multi-factor authentication imposed by Daon has limited the possibility of such a breach being successful in committing fraud for a long time. As such, consumers can rest easy knowing biometric multi-factor authentication is a fortified wall of security against deepfakes being used to access personal information.

AI

While AI has become THE technology of 2024, Clive said that prior to the current onslaught, Daon had already seen a 3-4-fold increase in accuracy of models in machine learning. This has also been seen with facial recognition systems, run at airports and by agencies like Homeland Security at border crossings to quickly confirm a person’s identity.

COVID

One of the ways you have probably interacted with Daon’s service unknowingly was via their VeriFLY service during the pandemic. Developed with limited time, it allowed the return of international travel by allowing online check-in that verified and kept up to date with COVID vaccination certificate rules between countries. Over sixteen million people used the service successfully, and it gave Daon experience in dealing directly with consumers and building consumer facing apps. This was the closest that Daon had gotten to being a directly consumer facing Software-as-a-Service (SaaS) business, and they carried out about a thousand updates to the apps in the space of two years, which wasn’t a possibility in their previous products.

But lessons from this B2C experiment have enabled Daon to launch their new TrustX platform. A cloud-native SaaS-based identity continuity platform, which is enabled by AI and ML, it enables businesses to integrate the software directly into their own products, featuring a no-code orchestration layer for rapid deployment and customisation to enhance user journeys. While maintaining full regulatory compliance, TrustX supports identity proofing and authentication which in turn will enable quick biometric authentication set up and recovery.

Customer Base: Where Operations Take Place

Facial biometric use for financial transactions is an arena that Daon has seen considerable growth in the last few years. With the proliferation of online purchasing and banking apps, biometric authentication has come to the masses; while biometrics have taken on a new importance, multi-factor authentication, with another factor e.g. possession or knowledge, remains a safeguard. A new area of research is enabling certain smaller purchases based on your behaviour.

In terms of geographic breakdown, Daon operates in most parts of the world. Clive also points out that the framework of the EU’s GDPR is a well adopted well understood framework with provisions for biometric data which enables the broader adoption of biometrics for consumer protection use cases such as opening accounts, account access, payment confirmation, account recovery etc. Outside of the EU differing legislation and regulatory environments to be considered.

Students Interested in Pursuing a Career in the Industry

For business, computing and mathematical students interested in a career with Daon and in the biometric authentication sphere, Clive suggests studying how AI would help improve cyber-attack detection. This area is an ongoing field of research, and is the main task in preventing presentation attacks, where fraudsters use imitations of a person’s biometric characteristics to verify their identity. This can be with expensive Mission Impossible style masks or full deep fake videos such as ones that made the news recently.

We wish to thank Clive for his time and for Daon’s support to TBR this year. For more information on Daon, visit their website www.daon.com and for careers visit http://www.daon.com/careers