Leading AI: What’s Next for Nvidia?

Sean Gleeson

In recent years, artificial intelligence (AI) has completely transformed our way of living, from how we learn to how we work. AI has been especially attractive to students; stressing over a convincing email for an assignment extension or thinking of a new business idea for a social innovation class has now become automated. But how did this all come about?

Background

Nvidia, a company dominating the AI world, is largely responsible for the rapid rise and recognition of AI. Founded in 1993 by current CEO Jensen Huang, Nvidia has been described as the ‘world leader in chipmaking’, explaining their control of just under 90% of the AI market.

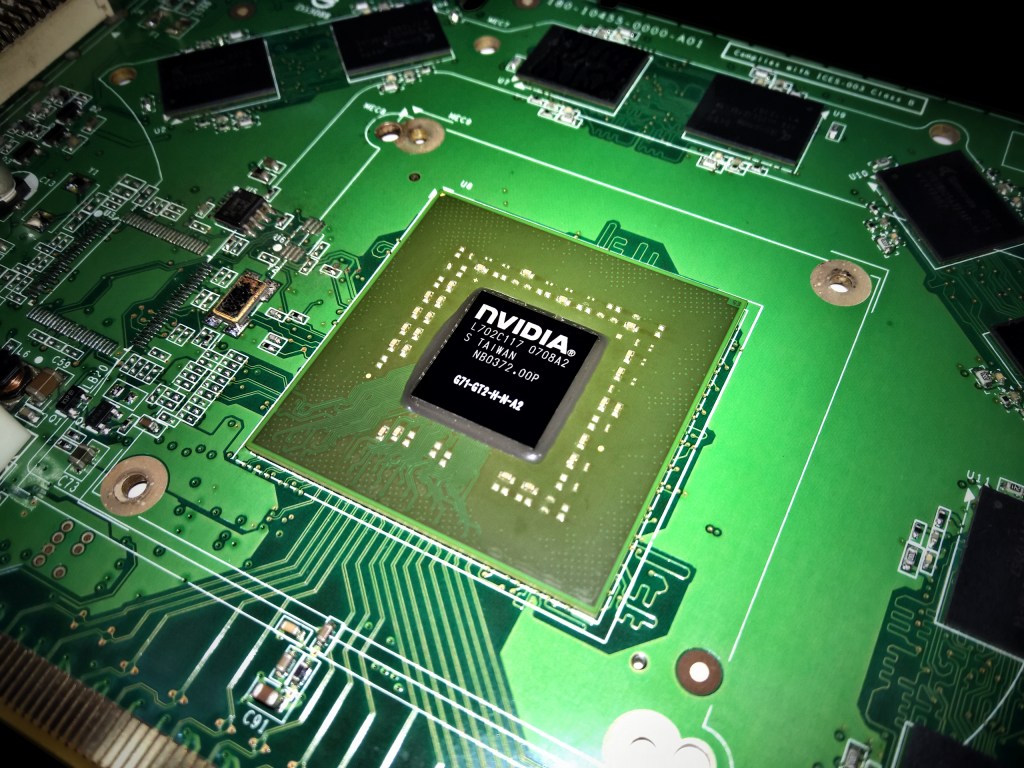

Nvidia manufactures graphics processing units (GPUs), which today are in soaring demand as they are the key feature of countless generative AI applications and models. These GPUs are more energy efficient and better able to handle sophisticated computing demands than CPUs (the traditional form of computing), making them suitable for AI applications like ChatGPT. At the heart of this chip manufacturing are enormous factories in Taiwan, the size of several football pitches that alone produce almost 90% of the world’s chips. TSMC (Taiwan Semiconductor Manufacturing Company), currently the world’s 9th largest company, has a very close relationship with Nvidia as the manufacturer of its microchips.

With these data centres and such an extensive roster of chips, Nvidia has gained more than just an edge over its competition through its pricing power. This has allowed its domination in the chip market as a B2B company, climbing to become the one of the most valuable corporations globally. Despite their massive growth and success, many consumers still have not heard of Nvidia, even when the company’s value matches other tech giants that have been dominating markets for decades.

Scaling & Growth

Nvidia’s rapid rise in recent years makes it difficult to predict its next steps – most experts predict that a smaller level of growth will be maintained and that Nvidia will establish itself as one of the long-term stalwarts of the tech world and stock market alike. In the last 5 years, the company’s market value has shot up by 700% since the uptake of generative AI in early 2021.

This type of rapid growth is extremely rare and should be handled with caution; such intense growth behaviour is unsustainable and could end in millions of lost investor equity. Indeed, in 2024 it has been easily the most volatile stock of the large companies on the market, with some citing the stock as more volatile than Bitcoin. Share price plunged by 23% during the last 3 weeks of July amid regulation breach allegations, and on the 5th of September Nvidia’s stock value declined by 9.5%, described as one of the worst days in the history of the stock market.

Competition, or Lack Thereof?

As in any market, the company’s future success also depends on the actions of its competitors. With Nvidia’s positioning, the market is rather monopolistic. However, with companies like AMD recently forming an alliance with Intel and Cisco to develop an open standard for high-speed communications between AI chips, the competitive landscape is growing. The fact that three companies of such scale are coordinating to try to catch up is telling of how far ahead Nvidia lies in the AI world.

Companies like Amazon and Meta are now looking at developing their own chips, putting massive capital expenditures into AI research and development. Nvidia will most likely benefit from some collaboration here; Microsoft, Meta, Amazon and Alphabet (owner of Google) make up 40% of Nvidia’s total revenue. With industry reliance comes a great deal of power, which can become excessive in the wrong hands. It may not necessarily be a good thing for AI development if Nvidia continues to be the dominant, monopolistic leader. With an investigation from the US Department of Justice for acquiring startup run.ai, Nvidia’s subtle yet aggressive business model could inhibit R&D efforts and healthy competition in the AI sphere.

The greatest issue facing Nvidia’s momentum now does not necessarily lie in its competition, but rather its supply and demand. Demand for chips is sky-high; companies that Nvidia sell to at mass scale, including Amazon and Meta, require hundreds of thousands of chips for their operations. Despite the size of the Taiwanese data centres and factories, and the efficiency of them, it is naturally difficult to meet such demands in a timely fashion. The capabilities of the suppliers must keep up with demand trends, a difficult task considering increased consumer expectations.

Where Next?

A potential influence on future performance for Nvidia lies in the political landscape. From a demand side, there may be further US barriers to Taiwan-imported chips to promote the use of domestic production, something former-president Trump has alluded to implementing if he wins the upcoming election. European countries are also looking at implementing such trade barriers. Additionally, from Taiwan’s side, their proximity to China could be a threat in the future, as China too is looking to mass-produce chips in the future.

At the moment, Nvidia certainly has the right blend of operations and strategy to thrive as the AI market leader. Its relationship with TSMC provides remarkable efficiency in the supply of products, and despite difficulty to meet the demands of tech companies, few other providers have the propensity to come close to supplying what is needed. With 88% of the world’s GPUs and a dominant strategy, change is unlikely unless regulators intervene heavily. From an AI development perspective, broader choice and lower costs would be desirable, however Nvidia investors will be happy to stake their claim if no serious competition surfaces. It seems fair to say that, despite the turbulence and volatility, the stock is a favourable choice for returns; strong revenues look set to continue, and even if growth declines, a small level of sustainable growth appears to be easily attainable. So, it seems that what Goldman Sachs strategists have called the most important stock of the year will continue to thrive in the future despite its challenges.